Ready-to-Move vs Under-Construction Property

What’s Actually Better in 2026?

This is one of the most common questions property buyers ask today.

“Should I buy a ready-to-move home?”

“Or should I invest in an under-construction project for better returns?”

In Noida and Gurgaon, both options look attractive.

But the right choice depends on your goals, timeline, and risk tolerance, not on generic advice.

Let’s break it down clearly.

What Is a Ready-to-Move Property?

A ready-to-move property is fully constructed and available for immediate possession.

Why buyers like it:

- No construction risk

- You see exactly what you’re buying

- Immediate possession or rental income

- No GST applicable

Ideal for:

- End-users who want to shift soon

- Buyers planning to save on rent

- Investors looking for stable rental yield

What Is an Under-Construction Property?

An under-construction property is still being built and will be delivered in the future.

Why buyers consider it:

- Lower entry price

- Flexible payment plans

- Higher appreciation potential

- Newer layouts and amenities

Ideal for:

- Long-term investors

- Buyers with no immediate possession pressure

- People comfortable with waiting

The Real Comparison (Beyond Marketing)

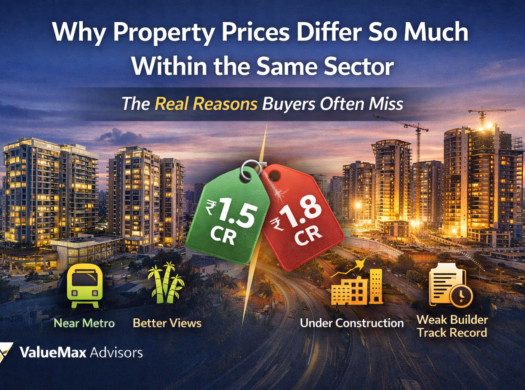

1. Price vs Value

- Ready-to-move: Higher upfront cost, lower uncertainty

- Under-construction: Lower price today, value realized later

In fast-growing corridors like Noida Expressway, Greater Noida West, and parts of Gurgaon, appreciation often happens during construction, not after possession.

2. Risk Factor

This is where many buyers underestimate reality.

Under-construction risks include:

- Construction delays

- Phase-wise delivery confusion

- Cash-flow stress if possession is delayed

Ready-to-move risks are lower, but:

- You may overpay in a stagnant micro-market

- Older inventory may need renovation

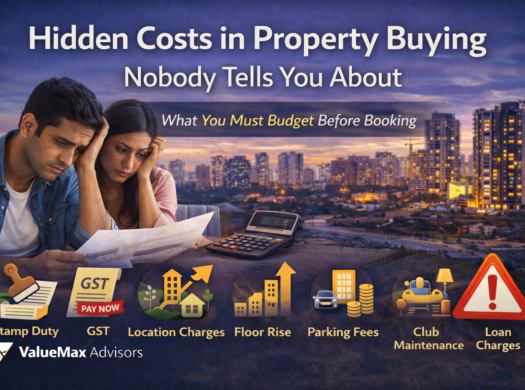

3. Tax & Cost Considerations

- Under-construction:

- GST applicable

- No rental income till possession

- Ready-to-move:

- No GST

- Immediate rental income possible

For investors, this can significantly impact short-term cash flow.

4. Rental Yield Reality

Many buyers assume new projects = better rent.

Not always true.

Rental demand depends on:

- Location

- Connectivity

- Office hubs nearby

- Livability, not just amenities

A well-located ready-to-move property often outperforms a new but poorly connected project.

So… What Should You Choose in 2026?

Choose Ready-to-Move if:

- You want to shift within 6 months

- You don’t want construction uncertainty

- Rental income matters immediately

- You value certainty over speculation

Choose Under-Construction if:

- You can wait 2–4 years

- Your goal is capital appreciation

- The builder has a strong delivery track record

- The location shows future demand indicators

The Biggest Mistake Buyers Make

Choosing based on discounts and offers, not fundamentals.

A cheaper under-construction property in the wrong location can underperform.

An expensive ready-to-move property in a saturated market can stagnate.

There is no universal winner.

There is only a right fit for your goal.

Final Thought

In 2026, the smarter question isn’t:

“Which is better?”

It’s:

“Which option aligns with my timeline, risk appetite, and financial plan?”

That answer changes from buyer to buyer.

Need clarity before deciding?

ValueMax Advisors helps buyers compare ready-to-move and under-construction options with real market data, not sales pressure.

📞 Speak with our team to understand what truly makes sense for you.